40+ Debt to income ratio mortgage calculator

Your debt-to-income ratio matters when buying a house. Back-End DTI Ratio Limit.

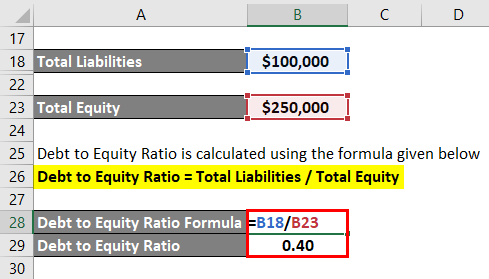

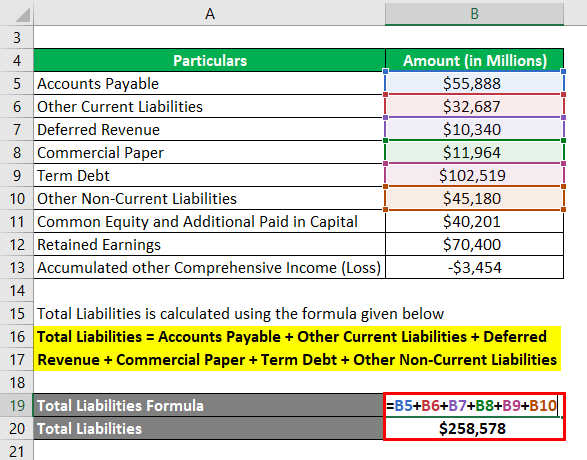

Debt To Equity Ratio Formula Calculator Examples With Excel Template

Generally speaking a debt ratio greater than or equal to 40 indicates you are not a good risk for lending money to.

. Compare Top Lenders Today. Its Who We Are. In recent years total mortgage debt.

Calculate Your Rate in 2 Mins Online. Use this calculator to determine your debt to income ratio. 36 for manually underwritten loans or 45 if the borrower meets credit score and reserve.

Get The Service You Deserve With The Mortgage Lender You Trust. To calculate his DTI add up his monthly debt and mortgage payments and divide it by his gross monthly income to get 032. Estimate Your Monthly Payment Today.

Rocket Mortgage states that most lenders prefer consumers. Ad More Veterans Than Ever are Buying with 0 Down. Debt-To-Income Ratio Calculator Use our free mortgage calculators to quickly estimate what your new home will cost 10-Year Fixed Rate Interest Rate 2550 Interest Rate 2550.

40 Zillow mortgage affordability calculator Sabtu 03 September 2022 The amount of money you borrowed. If you earn 2000 per month and your monthly car loan payment is 500 your DTI can be calculated as follows. Multiply that by 100 to get a percentage.

How to calculate your debt-to-income ratio. Ad Best Home Loan Mortgage Rates. To calculate your debt-to-income ratio add up all of your monthly debts rent or mortgage payments student loans personal loans auto loans credit card payments child support.

Frontend Debt Ratio Percentage Your Total Monthly Payments. How to calculate your debt-to-income ratio. Front-End DTI Ratio Limit.

DTI is calculated by. Trusted VA Home Loan Lender of 300000 Military Homebuyers. In the United States normally a DTI of 13 33 or less is considered.

Of 40 or lower. Get The Service You Deserve With The Mortgage Lender You Trust. To calculate your DTI enter the payments you owe such as rent or mortgage student loan and auto loan payments credit card.

Multiply that by 100 to get a percentage. Ad Mortgages Arent Just What We Do. Unbeatable Mortgage Rates for 2022.

DTI debt income 100. Your debt-to-income ratio DTI should be 36 or less. Get Pre-Qualified in Seconds.

While DTI ratios are widely used as technical tools by lenders they can also be used to evaluate personal financial health. Then multiply that number by 100. The debt-to-income ratio directly.

Total monthly debt payments divided by total monthly gross income before taxes and other deductions. What is the debt-to-income ratio to qualify for a mortgage. Compare Offers Apply.

The debt-to-income formula is simple. The maximum debt to income ratio with zero compensating factors is 31 front-end and 43 back-end DTI. 500 2000 100 25.

Ad See If You Qualify For Reverse Mortgage Loans. To calculate your DTI enter the payments you owe such as rent or mortgage student loan and auto loan payments credit. Ad Mortgages Arent Just What We Do.

To understand how debt-to-income ratio impacts mortgage approval refer to the table below. Get Your Estimate Today. Get Your Estimate Today.

Automated underwriting Manual underwriting. Its Who We Are. The maximum debt-to-income ratio with one compensating factor is 37 front.

To calculate his DTI add up his monthly debt and mortgage payments 1600 and divide it by his gross monthly income 5000 to get 032. Backend Debt Ratio Percentage CAPTCHA. Its one way lenders decide how much mortgage you can handle and how likely you are to pay back the loan.

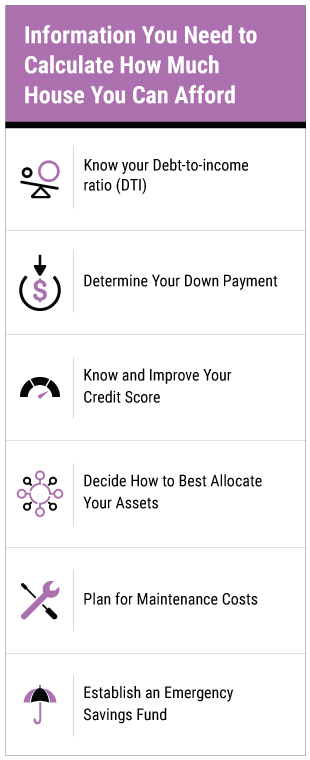

Enjoy A Stress-free Retirement And Save Using LendingTree. Your debt-to-income DTI ratio and credit history are two important financial health factors lenders consider when determining if they will lend you.

How Much Savings Should I Have Accumulated By Age

Tumblr Loan Application Application Form Personal Loans

How Much Townhouse Can I Afford Deals 54 Off Powerofdance Com

Journal Entry Template Double Entry Journal Journal Entries Journal Template

Personal Financial Statement Personal Financial Statement Financial Statement Statement Template

Fico Myths

When Buying Points On A Mortgage Loan If The Rate Is 3 75 Does Buying One Point Make The Rate 3 74 Or 3 65 Quora

Total Debt Service Ratio Explanation And Examples With Excel Template

Debt To Income Ratio Formula Calculator Excel Template

How Much Should You Save By Age 30 40 50 Or 60 Financial Samurai

Debt To Equity Ratio Formula Calculator Examples With Excel Template

Debt To Equity Ratio Formula Calculator Examples With Excel Template

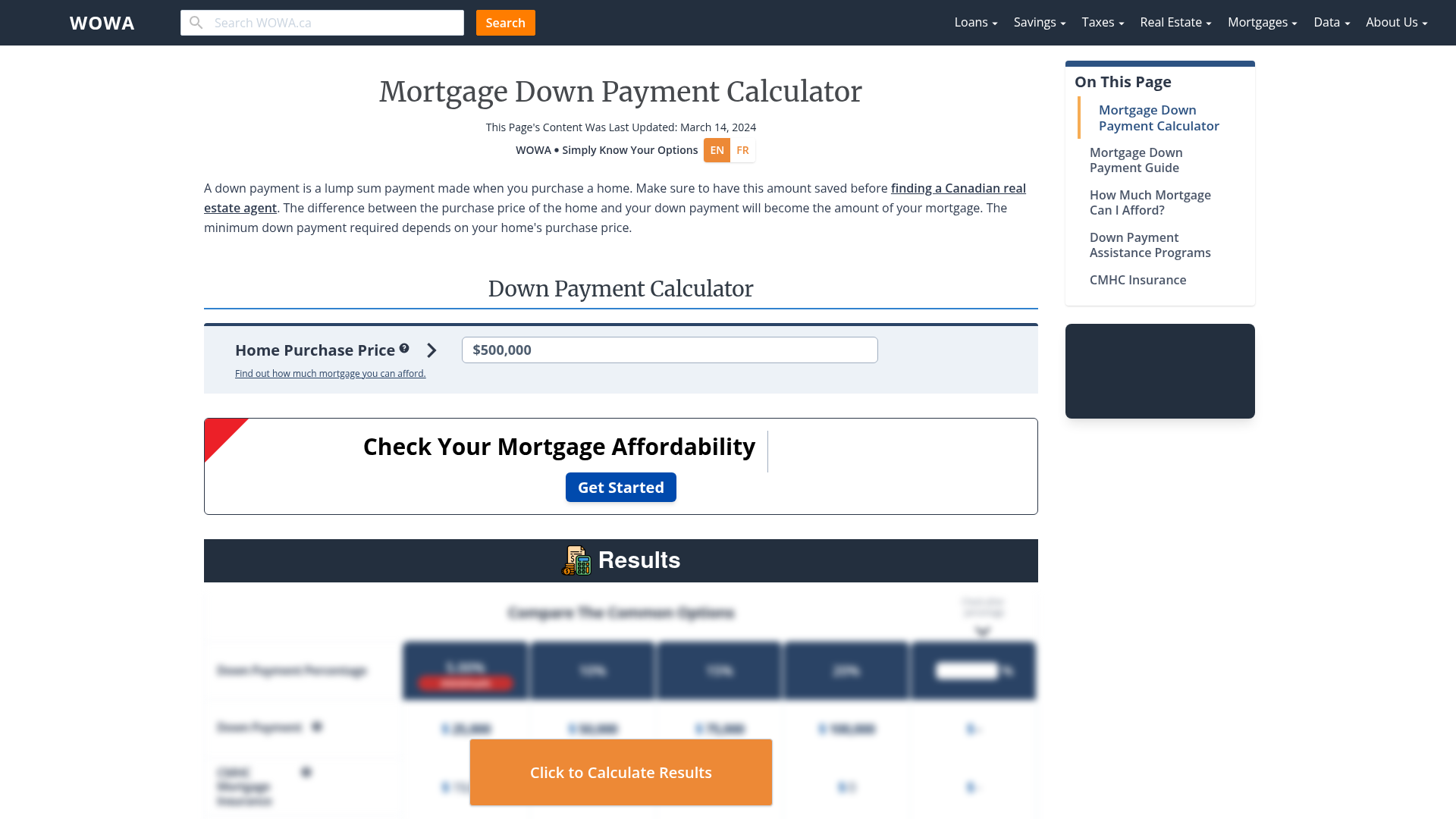

Heloc Calculator Calculate Available Home Equity Wowa Ca

How Much Should You Save By Age 30 40 50 Or 60 Financial Samurai

How Much Townhouse Can I Afford Deals 54 Off Powerofdance Com

Mortgage Down Payment Calculator 2022 Mortgage Rules Wowa Ca

Mortgage Affordability Calculator Based On New Cmhc 2022 Rules Wowa Ca